rhode island tax table

Latest Tax News. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599.

Form Sales Tax Rate Table Fillable 7 Tax Rate

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

. We last updated Rhode Island Tax Tables in. Compare your take home after tax and estimate. 3 rows The Rhode Island tax tables here contain the various elements that are used in the Rhode.

Assessment Date December 31. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of. Find your income exemptions.

Rhode Islands 2022 income tax ranges from 375 to 599. Details on how to. Find your pretax deductions including 401K flexible account.

2022 Rhode Island Sales Tax Table. 2022 Filing Season FAQs - February 1 2022. RHODE ISLAND TAX RATE SCHEDULE 2018 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 62550 142150 But not over Pay--of the amount over.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. 2022 Rhode Island Sales Tax Table. Rhode Island Income Tax Rate 2020 - 2021.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. PPP loan forgiveness - forms FAQs guidance. Rhode Island Income Tax Forms.

UI Customer 1099 Form. FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. 5 rows More about the Rhode Island Tax Tables.

2016 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This page has the latest Rhode. 2022 IFTA Return Filing Guidance - April 26 2022.

Rhode Island Division of Taxation. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. 2022 Rhode Island Sales Tax Table. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

The state income tax table can be found inside the Rhode Island. 2022 Rhode Island Sales Tax Table. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Historical Rhode Island Tax Policy Information Ballotpedia

Where S My Rhode Island State Tax Refund Taxact Blog

Rhode Island State Tax Tables 2022 Us Icalculator

Form Sales Tax Rate Table Fillable 7 Tax Rate

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island Income Tax Brackets 2020

Rhode Island Sales Tax Small Business Guide Truic

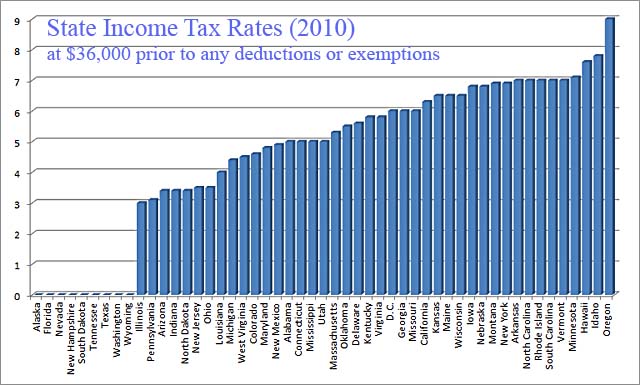

Individual Income Tax Structures In Selected States The Civic Federation